Now we’re looking after your online privacy, so you can keep loving what technology adds to your life.

-

We detect

Our proprietary monitoring tools help you identify threats to your data and identity.

-

We resolve

Privacy Advocates® are available 24/7 to manage your recovery and restore your identity.

-

We reimburse

We'll cover the cost for many of your out-of-pocket expenses, lost wages, or legal fees.†

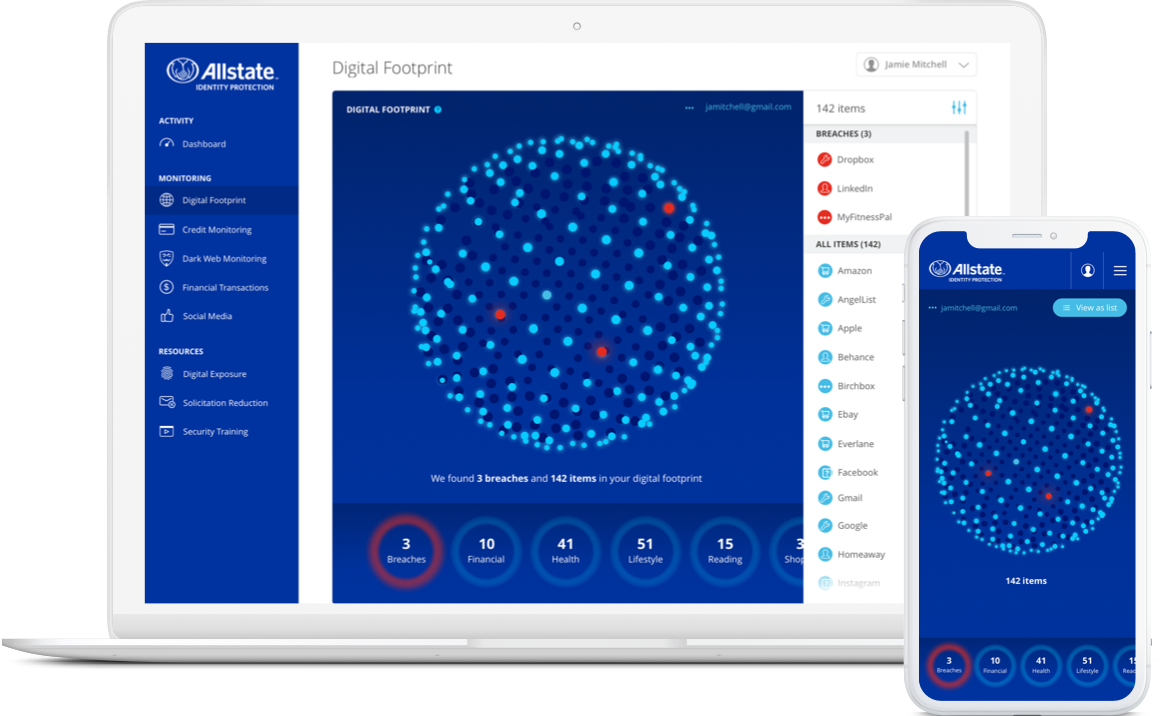

Stay a step ahead with Allstate Digital FootprintTM

All the incredible things you do online require something — data. A “digital footprint” is a collection of all the data you’ve left behind that might expose your identity.

Our new proprietary tool offers a simple way for you to see what accounts you have online, the data you’ve shared, and what personal information might leave you exposed.

Choose the plan that's right for you

- Allstate Digital Footprint* See a list of your online accounts and receive alerts if we find known data breaches that may affect you.

- Full-service remediation We fully manage identity remediation cases from start to finish.

- SSN Monitoring Alerts if we find your Social Security number for sale in hacker forums.

- Financial monitoring* Proactive monitoring to help you detect financial fraud.

- $50,000 expense coverage We’ll reimburse up to $50,000 of your out-of-pocket costs for fraud.†

- $50,000 stolen funds reimbursement We'll reimburse up to $50,000 for stolen funds taken from your bank account, health savings account, and 401(k) plan.†

- $50,000 401(k) & HSA reimbursement Allstate Identity Protection will reimburse funds stolen from often overlooked accounts like 401(k)s and HSAs.

- Social media monitoring* We’ll alert you if we find someone has taken over your social media accounts.

- Credit card transaction monitoring* Security alerts help confirm your transactions are really yours.

- Dark web monitoring* Receive alerts if our bots and human intelligence operatives find your compromised credentials in closed hacker forums.

- Identity health status We’ll provide a score that shows how at-risk your identity is.

- Status email Monthly email shows your Identity Health status.

- Solicitation reduction* We’ll help you opt-out of scam calls, pre-approved credit offers, and junk mail.

- Breach notifications We send alerts if we find known data breaches that may affect you.

- Email scan Alerts you if your email address is mentioned, traded, or sold on the dark web

- Credit/debit card scan We'll alert you if we find that your credit or debit card numbers is mentioned, used, or for sale.

- Web login scan If any of your account usernames or passwords are mentioned on the dark web, we'll alert you.

- Identification monitoring You'll receive an alert if we find your driver’s license or passport numbers on the dark web.

- Credit monitoring Monitors key changes to your credit with a leading credit bureau, and alerts you to help detect fraud.

- High risk transaction monitoring We alert for non-credit-based transactions like student loan activity and medical billing.

- Student loan activity monitoring Alerts you if a new student loan application is made in your name.

- Credit card transaction monitoring Security alerts help confirm your transactions are really yours.

- Bank account transaction monitoring Security alerts so you can stay on top of your financial transactions.

- 401(k) transaction monitoring Security alerts so you can respond quickly to suspicious behavior.

- Social reputation monitoring We watch for vulgarity, threats, explicit content, violence, and cyberbullying.

- Account takeover protection We’ll alert you if it looks like someone has taken over your social accounts.

- Tax fraud refund advance We’ll advance your tax refund if someone fraudulently files and receives it on your behalf.

- Email support Our Privacy Advocates work in house, and are available 24/7 via email.

- Full-service remediation We fully manage your identity remediation case from start to finish.

- 24/7 support line Our U.S.-based Privacy Advocates are available 24/7.

- Lost wallet assistance If you lose your wallet, we'll walk you through the process of replacing any lost content.

- Allstate Digital Footprint* See a list of your online accounts and receive alerts if we find known data breaches that may affect you.

- Full-service remediation We fully manage identity remediation cases from start to finish.

- SSN Monitoring Alerts if we find your Social Security number for sale in hacker forums.

- Enhanced financial monitoring* We help protect your finances with alerts triggered by bank accounts, credit and debit cards, 401(k) plans, student loan applications, and medical billing requests.

- $500,000 expense coverage We’ll reimburse up to $500,000 of your out-of-pocket costs for fraud.†

- $500,000 stolen funds reimbursement We'll reimburse up to $500,000 for stolen funds taken from your bank account, health savings account, and 401(k) plan.†

- $50,000 401(k) & HSA reimbursement Allstate Identity Protection will reimburse funds stolen from often overlooked accounts like 401(k)s and HSAs.

- Social media monitoring* We’ll alert you if we find someone has taken over your social media accounts.

- Credit card transaction monitoring* Security alerts help confirm your transactions are really yours.

- Dark web monitoring* Receive alerts if our bots and human intelligence operatives find your compromised credentials in closed hacker forums.

- Identity health status We’ll provide a score that shows how at-risk your identity is.

- Status email Monthly email shows your Identity Health status.

- Solicitation reduction* We’ll help you opt-out of scam calls, pre-approved credit offers, and junk mail.

- Breach notifications We send alerts if we find known data breaches that may affect you.

- Email scan Alerts you if your email address is mentioned, traded, or sold on the dark web

- Credit/debit card scan We'll alert you if we find that your credit or debit card numbers is mentioned, used, or for sale.

- Web login scan If any of your account usernames or passwords are mentioned on the dark web, we'll alert you.

- Identification monitoring You'll receive an alert if we find your driver’s license or passport numbers on the dark web.

- Credit monitoring Monitors key changes to your credit with a leading credit bureau, and alerts you to help detect fraud.

- High risk transaction monitoring We alert for non-credit-based transactions like student loan activity and medical billing.

- Student loan activity monitoring Alerts you if a new student loan application is made in your name.

- Credit card transaction monitoring Security alerts help confirm your transactions are really yours.

- Bank account transaction monitoring Security alerts so you can stay on top of your financial transactions.

- 401(k) transaction monitoring Security alerts so you can respond quickly to suspicious behavior.

- Social reputation monitoring We watch for vulgarity, threats, explicit content, violence, and cyberbullying.

- Account takeover protection We’ll alert you if it looks like someone has taken over your social accounts.

- Tax fraud refund advance We’ll advance your tax refund if someone fraudulently files and receives it on your behalf.

- Email support Our Privacy Advocates work in house, and are available 24/7 via email.

- Full-service remediation We fully manage your identity remediation case from start to finish.

- 24/7 support line Our U.S.-based Privacy Advocates are available 24/7.

- Lost wallet assistance If you lose your wallet, we'll walk you through the process of replacing any lost content.

Built for your peace of mind

Data Breach Alerts

We send alerts every time there’s a data breach so you can take action immediately and prevent possible theft.

Bank Account Monitoring

Alerts triggered from bank accounts, credit and debit cards, 401(k) plans, and other investment accounts help you protect your finances.

Dark Web Monitoring

Our bots and human intelligence operatives scan the dark web and closed hacker forums for compromised credentials.

Social Media Monitoring

We keep tabs on social accounts for everyone in the family, and alert for inappropriate interactions, objectionable language, and known hacker activity.

High Risk Transaction Monitoring

We go beyond traditional credit monitoring to alert for suspicious activity — like medical billing, cash advances, and student loan withdrawals.

Lost Wallet Assistance

Easily store, access, and replace wallet contents. Our secure vault conveniently stores important information from credit cards, credentials, and documents.

Protection for the people who matter most

From toddlers to seniors, everyone is vulnerable to identity theft. Our family plans ensure up to four additional loved ones are covered, so you can spend less and protect more.**

†Identity theft insurance covering expense and stolen funds reimbursement is underwritten by American Bankers Insurance Company of Florida, an Assurant company. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

*Subscription renews at additional cost unless cancelled. Terms and conditions apply. Some key features require additional activation. Allstate Identity Protection is offered and serviced by InfoArmor, Inc., a subsidiary of The Allstate Corporation.

**Up to four additional family members can be added to your coverage. This extends to your dependent children, or other dependent family members, who may or may not live with you but who are supported financially by you. There is no age limit or floor for enrolled family members; from infants to seniors you support.